Policy Update: ARPA Funds for Nonprofits, Affordable Connectivity Program Ending, and more

Kristen Wood, Advocacy Contributor

Policy Update: ARPA Funds for Nonprofits, Affordable Connectivity Program Ending, and more

Kristen Wood, Advocacy Contributor

Nonprofit Connect Welcomes Kansas Nonprofit Chamber Members

Our membership is growing, and your network is expanding. Following the recent announcement of the dissolution of the Kansas Nonprofit Chamber (KNC), we have partnered with the KNC board to transition their membership to Nonprofit Connect.

Nonprofit Connect

Frequently Asked Questions for new Members coming from Kansas Nonprofit Chamber (KNC):

FAQs addressing most common questions for transition of new members from Kansas Nonprofit Chamber (KNC) to Nonprofit Connect.

Nonprofit Connect

Let's Talk About It | Episode 10 - Upward Management

Dr. Kevin Sansberry

Policy Update: Government Spending, Federal Regulation Proposals, and the Start of State Legislative Sessions

Kristen Wood, Advocacy Contributor

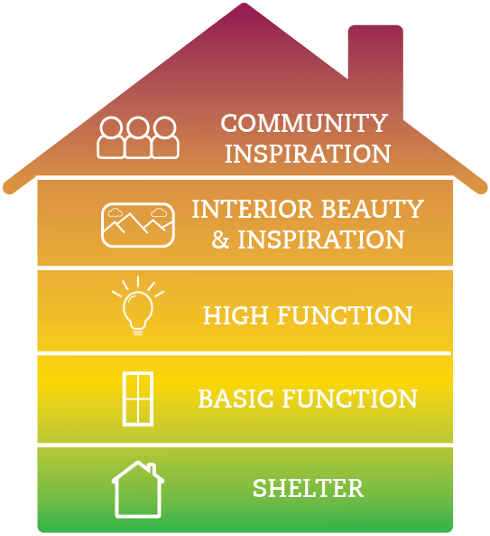

From Scarcity to Inspiration: Rethinking the Value of Nonprofit Facilities

Does the design of your nonprofit's facility reflect the values and principles your organization believes in? Many clients we serve at IFF are so accustomed to a mindset of scarcity and workaround that they struggle to envision operating any other way. The urge to economize is expected. Specific needs take priority over general wants; the tangible is more important than the intangible, and it can be challenging to think about the concerns of tomorrow until today’s crises are addressed. In the process, the

Joe Neri, CEO at IFF

Policy Update: Government Shutdown, Childcare, Overtime, and More

Kristen Wood, Advocacy Contributor

Let's Talk About It | Episode 9 - How to Protect Yourself From Toxicity

Dr. Kevin Sansberry

Sidney Smith recognized as 20 To Know: These nonprofit leaders fight the good fight by the Kansas City Business Journal

Luann Feehan